ccpickgame.ru

Tools

Is Gap Insurance Good

How gap insurance works. When you buy or lease a new car or truck, the vehicle starts to depreciate in value the moment it leaves the car lot. GAP insurance is best suited to those who have bought a new car and/or the amount their loan balance is greater than the value of their car. You may also want. Yes, it's worth it for many people since it offers peace of mind and protects against major financial loss. Gap insurance can be worth it if you finance or lease a vehicle. Although it does add an extra cost to your monthly insurance bill, it can also help you save. Gap insurance stands for Guaranteed Asset Protection insurance. It is an optional, add-on coverage that can help certain drivers cover the “gap”. So is Gap protection worth it? Both consumers and automotive experts alike agree that purchasing gap insurance is definitely worth it. Here is why you should. GAP insurance primarily helps cover the difference (aka “GAP") between what your car is worth and what you owe on your auto loan. Finance with CarEdge! · If you buy GAP insurance at the dealership, the cost is added onto the amount that you're financing. · To cancel your coverage, all you. Gap insurance is an optional auto insurance coverage that applies if your car is stolen or deemed a total loss. How gap insurance works. When you buy or lease a new car or truck, the vehicle starts to depreciate in value the moment it leaves the car lot. GAP insurance is best suited to those who have bought a new car and/or the amount their loan balance is greater than the value of their car. You may also want. Yes, it's worth it for many people since it offers peace of mind and protects against major financial loss. Gap insurance can be worth it if you finance or lease a vehicle. Although it does add an extra cost to your monthly insurance bill, it can also help you save. Gap insurance stands for Guaranteed Asset Protection insurance. It is an optional, add-on coverage that can help certain drivers cover the “gap”. So is Gap protection worth it? Both consumers and automotive experts alike agree that purchasing gap insurance is definitely worth it. Here is why you should. GAP insurance primarily helps cover the difference (aka “GAP") between what your car is worth and what you owe on your auto loan. Finance with CarEdge! · If you buy GAP insurance at the dealership, the cost is added onto the amount that you're financing. · To cancel your coverage, all you. Gap insurance is an optional auto insurance coverage that applies if your car is stolen or deemed a total loss.

Gap insurance is typically recommended for new vehicles, but it's often possible to purchase for used cars as well. Gap insurance can pay the difference. Is gap insurance worth it?” Given the low cost and the generous coverage, many drivers find that gap insurance is well worth the small investment for added. Gap insurance is a type of auto insurance typically purchased for leased or financed vehicles. If your vehicle is totaled, your standard auto insurance policy. Absolutely worth it % of the time. Only reason to not get it would be if you have at least k equity in the car the day you buy it, which. If there is any time during which you owe more on your car than its current value, gap insurance can be worth the money. If the car is totaled, you won't have. Gap insurance pays for some or all of the difference between the balance of your lease or loan and the claims payout for a covered total loss. investing in a gap insurance policy is a good idea if you have a new vehicle that's leased or financed and currently owe more than your car is worth. You. Key Takeaways · Gap insurance covers the difference between your vehicle's value and the amount you owe on your car loan or lease. · Gap insurance makes sense if. Before you drive home to Lakeland, you'll want to consider whether or not gap protection is worth it. Many consumers and experts agree that purchasing gap. If you're worried about potentially being underwater on your loan if your car gets totaled, then gap insurance may give you peace of mind. But if you have a. Gap insurance is an optional car insurance coverage that helps pay off your auto loan if your car is totaled or stolen and you owe more than the car's. You should always take Gap Insurance if buying a new car as it provides protection in case your car is totaled in an accident. It will cover the. But in those situations, gap coverage can save your bank account from being drained if your car is declared a total loss. Let's look at what gap insurance is. Guaranteed Auto Protection Insurance (GAP) is offered by Nissan and other financial institutions as a way of protecting you from financial disaster. Many Toyota insurance experts and consumers agree that buying gap insurance is worth the extra cost. Best Gap Insurance Companies. Travelers; The Hartford; Liberty Mutual; Nationwide; Kemper; Progressive; Esurance. Gap insurance is a type of car insurance that. Gap insurance helps pay the difference between what's owed on a vehicle loan and the actual value of it, if it's stolen or a total loss. Guaranteed Auto Protection Insurance (GAP) is offered by Nissan and other financial institutions as a way of protecting you from financial disaster. Buying GAP insurance gives you more freedom to shop around for a policy (like shopping around for car insurance), but you're responsible for paying monthly. Gap insurance is considered optional, but many Stamford drivers consider it well worth the investment. Not only will gap insurance protect your assets, but it.

Which Stocks Provide Dividends

A stock dividend is a payment to shareholders in the form of additional shares in the company. · Stock dividends are not taxed until the shares are sold by their. Generally, preferred stocks offer more dividends, but they do not come with voting rights in the company. (This usually isn't important to individual investors.). Stocks from the banking, consumer staples, and utilities sectors, for example, are known for steady dividends and lower volatility, but they also tend to offer. One of the most compelling cases for dividend investing, is that it provides a significant source of income for investors, while at the same time features. But, just as importantly, good dividend stocks can help you offset rising costs through both the income they provide and their stock price appreciation. You. The historical dividend information is provided by Mergent, a third party service, and Notified does not maintain or provide information directly to this. Dividend-paying stocks provide a way for investors to get paid during rocky market periods, when capital gains are hard to achieve. What are dividend stocks? Dividends are a type of payment used by companies to share profits with their shareholders. Dividends may be paid out on a monthly. Chevron (CVX) International Business Machines (IBM) and Altria Group (MO) are some of the most trending Dividend Stocks. A stock dividend is a payment to shareholders in the form of additional shares in the company. · Stock dividends are not taxed until the shares are sold by their. Generally, preferred stocks offer more dividends, but they do not come with voting rights in the company. (This usually isn't important to individual investors.). Stocks from the banking, consumer staples, and utilities sectors, for example, are known for steady dividends and lower volatility, but they also tend to offer. One of the most compelling cases for dividend investing, is that it provides a significant source of income for investors, while at the same time features. But, just as importantly, good dividend stocks can help you offset rising costs through both the income they provide and their stock price appreciation. You. The historical dividend information is provided by Mergent, a third party service, and Notified does not maintain or provide information directly to this. Dividend-paying stocks provide a way for investors to get paid during rocky market periods, when capital gains are hard to achieve. What are dividend stocks? Dividends are a type of payment used by companies to share profits with their shareholders. Dividends may be paid out on a monthly. Chevron (CVX) International Business Machines (IBM) and Altria Group (MO) are some of the most trending Dividend Stocks.

In summary, dividend-paying stocks may offer investors growth with less volatility relative to their non-dividend paying peers, and could provide a source of. Looking at average stock performance over a longer time frame provides a more granular perspective. For dividend-paying stocks, dividends are not. Stocks in the list are ranked by dividend yield. Go to our interactive provide a more personalized web experience. However, you can choose not to. A stock dividend is a dividend paid in shares, generally issued to provide common shareholders with a portion of their respective interest in retained earnings. 9 best dividend stocks · 1. Lowe's · 2. Realty Income · 3. Chevron · 4. Target · 5. Starbucks · 6. Brookfield Infrastructure · 7. Microsoft. attention to dividends. 2. Insight. Decade By Decade: How Dividends Impacted Returns. Looking at average stock performance over a longer time frame provides a. If you sell your stock before the ex-dividend date, you also are selling away your right to the stock dividend. Your sale includes an obligation to deliver any. Dividends are payments companies make to reward their shareholders for holding on to their stock. They represent a portion of a company's profit. Dividends are payments of income from companies in which you own stock. If you own stocks through mutual funds or ETFs (exchange-traded funds), the company. CDs, bond funds, and dividend stocks all offer ways to lock in yields. Long read. Go to article · The Best Way to Play the Stock Market's Worst Sector. Ian. The most comprehensive dividend stock destination on the web. Contains profiles, news, research, data, and ratings for thousands of dividend-paying stocks. Best dividend stocks · Comcast Corp. (CMCSA) · Bristol-Myers Squibb Co. (BMY) · Altria Group Inc. (MO) · Marathon Petroleum Corp. (MPC) · Diamondback Energy (FANG). A stock dividend is a portion of a companys profits owed to stockholders paid out to shareholders on a regular basis. Are dividend stocks worth it? Dividend. Dividend paying stocks are stocks that pay regular dividends to their holders. Dividend paying stocks provide reoccuring income in the form of dividends. Q. A dividend is an amount of money paid regularly by a company to its shareholders. Dividend stocks are popular among investors because they are typically well-. Dividend ETFs seek to provide high yields by investing in dividend-paying stocks. stocks that have a history of distributing dividends to their shareholders. Dividends are paid on AEP common stock on or about the 10th day of March, June, September and December to shareholders of record on 10th day of February, May. Investors often face a choice between Dividend Growth stocks and High Yield stocks when seeking income-generating investments. While High Yield stocks offer. Check out stocks offering high dividend yields along with the company's dividend history. You can view all stocks or filter them according to the BSE group or. dividend stocks with reinvestment of dividends will grow your provide dependable income, they can also erode the value of the stock.

Best Place To Do My Taxes

Best Overall: H&R Block · Best for Ease of Use: Jackson Hewitt · Best Online Experience: TurboTax Live · Best for Self-Employed: EY TaxChat. You can stop and start again at any point and your information and progress is saved. Do Not Sell Or Share My Personal Information. TermsPrivacySitemap. ©. I have used FreeTaxUSA to file my mom's taxes for the last 5 years and it's super easy and % free for federal e-file. How much do places charge to do taxes? Expect to pay, on average, $ Search top-tier programs curated by your interests. Let us know what type of. place so they can be accessed when it is time to file their taxes. FY When do I have to pay my property taxes? How do I check the status of my. Once you have filed your federal tax return, you are directed to the FileYourStateTaxes tool to file your Arizona state taxes. Direct File may be a good option. Take charge and prepare your own tax returns online or in-person with free tax software and expert support provided by Food Bank. Get help from an IRS-certified. TaxSlayer helps you easily file your federal and state taxes online. Learn about our tax preparation services and get started for free today! TurboTax® is the #1 best-selling tax preparation software to file taxes online. Easily file federal and state income tax returns with % accuracy to get. Best Overall: H&R Block · Best for Ease of Use: Jackson Hewitt · Best Online Experience: TurboTax Live · Best for Self-Employed: EY TaxChat. You can stop and start again at any point and your information and progress is saved. Do Not Sell Or Share My Personal Information. TermsPrivacySitemap. ©. I have used FreeTaxUSA to file my mom's taxes for the last 5 years and it's super easy and % free for federal e-file. How much do places charge to do taxes? Expect to pay, on average, $ Search top-tier programs curated by your interests. Let us know what type of. place so they can be accessed when it is time to file their taxes. FY When do I have to pay my property taxes? How do I check the status of my. Once you have filed your federal tax return, you are directed to the FileYourStateTaxes tool to file your Arizona state taxes. Direct File may be a good option. Take charge and prepare your own tax returns online or in-person with free tax software and expert support provided by Food Bank. Get help from an IRS-certified. TaxSlayer helps you easily file your federal and state taxes online. Learn about our tax preparation services and get started for free today! TurboTax® is the #1 best-selling tax preparation software to file taxes online. Easily file federal and state income tax returns with % accuracy to get.

Your security. Built into everything we do. · W-2 income · Interest or dividends (INT/DIV) that don't require filing a Schedule B · IRS standard. Find a VITA location. United Way VITA sites are opened for in-person Feel confident in your ability to do your taxes but don't want to pay for an. Learn how to decide between using an accountant to do your taxes or using tax prep software to do your taxes on your own Your Best Option for Filing Taxes. Cash App Taxes · FreeTaxUSA · H&R Block · Jackson Hewitt · TaxAct · TaxSlayer · TurboTax. Below is our list of local libraries providing tax assistance programs in Some library sites provide walk-up service and optional appointments. Please review the links at the bottom of the page, and choose the filing method that best fits your needs. taxes from your annuity. You can also obtain. your tax documents and let a professional take over. TurboTax has a similar service this year. Can I Do My Taxes From My Phone? Many of us are now used to. TaxSlayer helps you easily file your federal and state taxes online. Learn about our tax preparation services and get started for free today! how can they do my taxes and NOT worry about getting paid for it? Why did i After having other tax places do our taxes, we went to Tax Pros last year. Why pay for tax preparation when United Way offers services to do your taxes for free? With United Way's Free Tax Prep, what you save in fees could mean the. E-file your federal and state taxes online with TaxAct. Explore tax products for a wide range of tax filing situations and get your maximum tax refund. How are my pre-tax benefit program deductions shown in my W-2? Do I pay taxes for fringe benefits? What is the Domestic Partner benefit? Is the payment I. Find a VITA location. United Way VITA sites are opened for in-person Feel confident in your ability to do your taxes but don't want to pay for an. do the math for you, but they offer only basic guidance and your area. While this doesn't guarantee their trustworthiness, it's a good place to start. Feeling good about filing your own taxes but want to do it for free, without any hidden fees? We've got you. In-Person Tax Sites. Please click on the tax site. This searchable directory is intended to help you with your choice by providing a listing of preparers in your area It may take up to four weeks after. What must I do to get my correct part of the refund? Get IRS Form or How do I know if I am in the TOP database of delinquent debtors? Before. Preparing your return, but have questions? Enter your question and an IRS-certified volunteer will be in touch within two business days. Do Your Own Taxes for. We're not just local tax experts, we're your neighbors, and we're here to serve you. We take pride in the products and services we provide and are willing to. You can choose to have an IRS-certified volunteer prepare your taxes or provide coaching so you can prepare them yourself. take appointments at almost 3,

Which Credit Card Has Travel Insurance

Use the Visa insurance service for safe and comfortable travels Holders of Visa Platinum, Visa Signature, Visa Infinite, Visa Platinum Business and Visa. All three currently issued Freedom cards: Chase Freedom Unlimited, Chase Freedom Flex and Chase Freedom Rise offer their cardmembers basic travel insurance. The best travel insurance credit card is the Scotiabank Gold American Express card because it offers generous travel medical protection for up to 25 days . Retail Item Cover If you are a Card Member who has a Card with Complimentary Travel Insurance and need written confirmation that your American Express® Card. Chase Sapphire Card (Chase Benefits); United Explorer Visa Platinum Card (Explorer Card Benefits); CitiCards (CitCards Worldwide Travel Accident Insurance). All. Travel accident and emergency medical insurance* Covers you and your family against accidental death or dismemberment if you purchase common carrier travel. Depending on the TD credit card, travel benefits could include: Travel Medical Insurance. Trip Cancellation / Trip Interruption Insurance. Chase Sapphire Reserve The Chase Sapphire Reserve® is the best credit card for travel insurance because it provides one of the most extensive lists of travel. The World, Worl Elite and Platinum cards include comprehensive insurance. Use the Visa insurance service for safe and comfortable travels Holders of Visa Platinum, Visa Signature, Visa Infinite, Visa Platinum Business and Visa. All three currently issued Freedom cards: Chase Freedom Unlimited, Chase Freedom Flex and Chase Freedom Rise offer their cardmembers basic travel insurance. The best travel insurance credit card is the Scotiabank Gold American Express card because it offers generous travel medical protection for up to 25 days . Retail Item Cover If you are a Card Member who has a Card with Complimentary Travel Insurance and need written confirmation that your American Express® Card. Chase Sapphire Card (Chase Benefits); United Explorer Visa Platinum Card (Explorer Card Benefits); CitiCards (CitCards Worldwide Travel Accident Insurance). All. Travel accident and emergency medical insurance* Covers you and your family against accidental death or dismemberment if you purchase common carrier travel. Depending on the TD credit card, travel benefits could include: Travel Medical Insurance. Trip Cancellation / Trip Interruption Insurance. Chase Sapphire Reserve The Chase Sapphire Reserve® is the best credit card for travel insurance because it provides one of the most extensive lists of travel. The World, Worl Elite and Platinum cards include comprehensive insurance.

Travel medical insurance protects you, the cardholder, in the event you have to receive urgent medical care while you're on a trip. Credit card companies. In just a few minutes, you can see what travel insurance you have on your RBC credit card, whether you have enough coverage for your trip, or if you need to. Usually the best cards that provide travel insurance are air mile cards, such as Citi PremierMiles Visa, DBS Altitude, UOB PRVI Miles and AMEX KrisFlyer. There. Credit card travel insurance is typically activated when you use your credit card to pay for travel-related expenses, and each credit card clearly explains how. With the BMO AIRMILES† World Elite* Mastercard* for travel, you can access over 12 types of insurance coverages, including purchase protection, travel accident. have or is available to you, including through other insurers, as a member of an organization, or through your credit card program(s). If you have any. The Chase Sapphire Reserve card and United Club Infinite card come with $, in emergency evacuation coverage plus $2, for emergency medical and dental. Chase Sapphire Preferred and Reserve are generally regarded as having decent travel protections, but if travel insurance is something that is. Travel insurance is underwritten by CUMIS General Insurance Company, a member of The Co-operators Group of Companies and administered by Allianz Global. BMO Roadside Assistance · BMO Pay-As-You-Go RoadAssist · BMO Total Travel and Medical Protection · BMO Medical Protection · BMO Travel Protection with Trip. Scotia Travel Insurance offers a COVID Pandemic Travel Plan, which offers coverage in the event of quarantine outside of Canada. Coverage is for expenses. Credit card travel insurance can reimburse cardholders in the event of canceled trips, missed connections, lost or delayed luggage, or even death. Credit card travel insurance protects you from some unforeseen circumstances that may disrupt your travel plans. Travel medical insurance protects you, the cardholder, in the event you have to receive urgent medical care while you're on a trip. Credit card companies. What does credit card travel insurance cover? · Baggage loss and delay · Trip interruption · Flight delay · Emergency medical coverage · Rental car damage coverage. Travel insurance does not cover everything. Please refer to the policy wording for full terms and conditions, including limitations and exclusions. Travel. Many credit cards and group coverage insurance plans come with the additional perk of automatic travel insurance at no additional cost. Trip Cancellation/Trip Interruption Insurance · You have coverage for up to $ per insured person for your trip. ; Delayed and Lost Baggage Insurance. Credit card travel insurance is a benefit included with certain travel credit cards. You'll often see this perk with travel rewards credit cards. Credit cards with travel insurance provide comprehensive coverage (emergency medical care, trip cancellation or interruption, accidents, lost baggage).

Buy Your Own Vending Machine

Shop our selection of custom vending machines at eVending today! These models can be customized to your needs and are ideal for vending various products. Equipment leasing: Consider leasing options for vending machines, which can provide flexibility and potentially lower upfront costs compared to purchasing. Sam's Club is your one-stop shop for vending machines, concession and vending supplies. Wide variety of snack machines, beverage machines, gumball machines. A custom machine can cost as little as $10, or upwards of $, The extent of the customization will dictate the cost. If your idea lines up with. Don't wait until you absolutely need the money to educate yourself about the financing options available to you. 6. Purchase equipment for your vending machine. Our VENDING MACHINES are geared toward medium size businesses that can offer any variety of snacks and drinks for employees and customers at any time. All. 1. Research and Planning: Conduct market research to identify the demand and potential profitability of vending machine businesses in your target location. Running a vending business includes: selecting and securing locations for Vending Machine placement, purchasing and placing vending equipment,; choosing and. No need to establish your own systems and procedures; Easier to make your business turnkey from the get-go. Prior to buying: Carefully review any legal. Shop our selection of custom vending machines at eVending today! These models can be customized to your needs and are ideal for vending various products. Equipment leasing: Consider leasing options for vending machines, which can provide flexibility and potentially lower upfront costs compared to purchasing. Sam's Club is your one-stop shop for vending machines, concession and vending supplies. Wide variety of snack machines, beverage machines, gumball machines. A custom machine can cost as little as $10, or upwards of $, The extent of the customization will dictate the cost. If your idea lines up with. Don't wait until you absolutely need the money to educate yourself about the financing options available to you. 6. Purchase equipment for your vending machine. Our VENDING MACHINES are geared toward medium size businesses that can offer any variety of snacks and drinks for employees and customers at any time. All. 1. Research and Planning: Conduct market research to identify the demand and potential profitability of vending machine businesses in your target location. Running a vending business includes: selecting and securing locations for Vending Machine placement, purchasing and placing vending equipment,; choosing and. No need to establish your own systems and procedures; Easier to make your business turnkey from the get-go. Prior to buying: Carefully review any legal.

Have you ever wondered what it takes to start your own vending machine business There are a number of resources to buy vending machines from. Here are. In this guide, learn how to create, finance and operate your own vending machine company. You just need enough money to buy a vending machine and fill. However, if you do decide to buy your own machines, there are a few things you should keep in mind. First, make sure to buy reliable machines from a reputable. Just like location matters when buying real estate, the same applies to your vending machine. No you don't need a license to start your own vending machine. We sell high-quality, affordable vending machines. We provide tech-support and training for every new or used vending machine you buy. The option to take over an established company is much simpler than doing everything yourself. Also, a geographic area may already be well-stocked with vending. To add the following enhancements to your purchase, choose a. Customized vending machines provide the opportunity for buyers to purchase their your own vending machine business. Finally, this type of business is highly. and build your financial Say you own a commercial property like a cinema or a hair salon. You could buy and install a vending machine on your property. Buying a vending machine can be a profitable business venture if it is done correctly. However, there are several factors to consider when. your own company. They not only give information and share resources, but they can also purchase wholesale products on your behalf to distribute at, perhaps. There are many types of machines to start your own vending machine business: If you are looking for a bank loan to help you purchase your equipment and. In this guide, learn how to create, finance and operate your own vending machine company. You just need enough money to buy a vending machine and fill. Have you ever wondered what it takes to start your own vending machine business There are a number of resources to buy vending machines from. Here are. buying an existing vending machine business to lower your startup costs and Leave a comment if you own a vending machine so others can learn from your. The most straightforward option is simply to buy a vending machine with cash that you have saved or perhaps purchase with a credit card. Since the cost of a. and more. If your preference is a Specialty machine for unique items visit Specialty Vending Systems to have your own machine customized. We have a showroom. If you want to install several new high-tech custom vending machines throughout an area, your costs will be significantly higher than if you set up a single pre. How can I sell my vending business route? If you currently have a vending machine business and would like to sell the following are some suggestions to help.

How Much Do Painters Charge By The Hour

However, on average, painters in Colorado typically charge between $20 and $50 per hour, with an average cost of around $35 per hour. This estimate can also. The average home painting project ranges from $ to $10, depending on various factors such as size, how many rooms are being painted, etc. Prep work simply. The average cost to paint a small brick house can start around $ However, that price can skyrocket all the way up to $9, and over for much larger jobs. On average a painter covers approximately - square feet an hour. Labor costs are generally charged on an hourly basis, and you can expect to pay $60 -. /hr is a reasonable average painting rate for my area. Then add around % to your total for your other expenses and unknown costs. Contractors that specialize in office painting charge anywhere from $50 to $65 per hour. If we assume an hourly rate of $60 per hour, the labour cost for the. Labor charges for painting can range from $20 to $50 per hour, depending on the complexity of the job and local rates. How much does it cost to paint a 12× How Much Do Painters Charge Per Hour? The average hourly rate for a professional painting contractor is $$ A professional painter can paint. Some painters may choose to estimate per square foot of paintable area. Others may charge by the hour, particularly if they are doing small jobs. A fair hourly. However, on average, painters in Colorado typically charge between $20 and $50 per hour, with an average cost of around $35 per hour. This estimate can also. The average home painting project ranges from $ to $10, depending on various factors such as size, how many rooms are being painted, etc. Prep work simply. The average cost to paint a small brick house can start around $ However, that price can skyrocket all the way up to $9, and over for much larger jobs. On average a painter covers approximately - square feet an hour. Labor costs are generally charged on an hourly basis, and you can expect to pay $60 -. /hr is a reasonable average painting rate for my area. Then add around % to your total for your other expenses and unknown costs. Contractors that specialize in office painting charge anywhere from $50 to $65 per hour. If we assume an hourly rate of $60 per hour, the labour cost for the. Labor charges for painting can range from $20 to $50 per hour, depending on the complexity of the job and local rates. How much does it cost to paint a 12× How Much Do Painters Charge Per Hour? The average hourly rate for a professional painting contractor is $$ A professional painter can paint. Some painters may choose to estimate per square foot of paintable area. Others may charge by the hour, particularly if they are doing small jobs. A fair hourly.

Professional painters, who bring years of experience, skill, and expertise to the table, usually command rates in the range of $65 to $95 per hour. These rates. Budget around $ to $ for all of the materials, including paint and equipment. Painting your home's interior can take anywhere from a few hours to a few. Interior Painting Pricing ; Basic trim work · Starting at $ ; ceiling · Starting at $ ; surface prep per hour · Starting at $ ; Popcorn ceiling. Hourly rates for professional painters can cost you between $20 and $50 for a basic paint job, or $ or more per hour for more specialized work like painting. /hr is a reasonable average painting rate for my area. Then add around % to your total for your other expenses and unknown costs. The “going rate” per painter is around an average of $$50 per hour. Painters who work hourly typically bill anywhere from $$45 an hour, depending on their. This is usually the most common method of billing and usually ranges from $25 to $50 per hour. Are you considering hiring a professional painter? If so, you may. Budget around $ to $ for all of the materials, including paint and equipment. Painting your home's interior can take anywhere from a few hours to a few. Most professional painters charge $2 to $6 per square foot of paintable area. Less commonly, they'll charge anywhere from $20 to $50 an hour. In some areas with. Cost of interior house painting per room ; Average cost per room, $ – $ ; Cost per square meter, $10 – $60 ; Cost per hour, $65 – $95 ; Cost per day, $ –. Most companies have an hourly rate between $40 and $95 per hour for interior painting projects. What Does it Cost to Paint interior of House? Read more. Professional painters charge between $55 and $65 per hour for their labor, which means a 16, square foot exterior warehouse project will take around 53 hours. Professional painters have rates that vary between around $35 and $45 per hour for the average home; this price per hour does not include the cost for paint and. Some contractors use a rough base rate of $ or $ per square foot, some multiply 4 to 6 times the paint cost, some estimate the time the job will take. To paint a surface of to square feet, an average painter may need only an hour to finish the task. If you're planning to get two coats of paint then. Most professional painters charge $2 to $6 per square foot of paintable area. Less commonly, they'll charge anywhere from $20 to $50 an hour. In some areas with. How much do Professional Painter jobs pay in Connecticut per hour? The average hourly salary for a Professional Painter job in Connecticut is $ an. The average hourly rate for painters is $ per hour. Painter salary FAQs. What state pays Painters the most? How do I know if I'm being paid fairly as a. Ask them what the cost will be per square foot and what their hourly rate is so you can get an estimate for the entire job. How Much Does It Cost to Paint a. Residential Painting Cost A single-story brick veneer home may cost between $ and $+GST to paint. While it might take an average of between $

Learning To Trade Options For Dummies

Learn the basics of options trading and build a solid foundation and understanding of how options really work with Option Alpha's beginner track. To start out your options trading education, we recommend the following: · FREE Webinars · Trading Rules of Thumb · The PriorityOne Email Archive · Option Trading. It is easy to follow and not riddled with complex examples. I hesitated about buying a book "for dummies" but I was an option trading dummy and this works out. Learn the essentials of options trading with our options trading course for beginners in English & gain the confidence to start trading in no time. It's important to note that exercising is not the only way to turn an options trade profitable. Investing for beginners · Finding stock and sector ideas. Day Trading Options for Beginners · Day trading options for income are a very popular strategy. How to trade options for beginners is a videos series dedicated to helping you learn how to use put, covered call and LEAP options to. Options trading gives traders more ways to seek opportunities within the asset market. They're a relatively advanced strategy, enabling the buying or selling of. Options are financial contracts that give the holder the right to buy or sell a financial instrument at a specific price for a certain period of time. Learn the basics of options trading and build a solid foundation and understanding of how options really work with Option Alpha's beginner track. To start out your options trading education, we recommend the following: · FREE Webinars · Trading Rules of Thumb · The PriorityOne Email Archive · Option Trading. It is easy to follow and not riddled with complex examples. I hesitated about buying a book "for dummies" but I was an option trading dummy and this works out. Learn the essentials of options trading with our options trading course for beginners in English & gain the confidence to start trading in no time. It's important to note that exercising is not the only way to turn an options trade profitable. Investing for beginners · Finding stock and sector ideas. Day Trading Options for Beginners · Day trading options for income are a very popular strategy. How to trade options for beginners is a videos series dedicated to helping you learn how to use put, covered call and LEAP options to. Options trading gives traders more ways to seek opportunities within the asset market. They're a relatively advanced strategy, enabling the buying or selling of. Options are financial contracts that give the holder the right to buy or sell a financial instrument at a specific price for a certain period of time.

Get Together Finance is here with options trading for Beginners. Learn key approaches in options trading such as put-call parity, Investing basics, etc. Options Trading for Beginners Stock Market Guides is not a financial advisor. Our content is strictly educational and should not be considered financial. Yes You Can Learn Options Trading Without Ever Investing Before Through: A Demo Trading Account Under Any Broker Platform; A Professional. Buying calls is a great options trading strategy for beginners and investors who are confident in the prices of a particular stock, ETF, or index. Buying calls. Two types of options: call options (calls) and put options (puts). A call option gives you the OPTION to BUY a stock at the strike price on or. Investing for beginners · Finding stock and sector ideas · Advanced trading strategies · Trading options · Stocks · Using technical analysis. © by. Trading options enables you to create various trading strategies and control your risk and profit potential on trade entry with defined or undefined risk. Options TradingOptions Trading for Beginners – The 3 Basic Things to Learn How to Trade. Options Trading · Stock Market News · U.S. Investing. Options Trading. Day Trading Options for Beginners. By Lucien Bechard. Updated May 1, 11 Another thing we recommend when learning how to day trade options for income is. Options Trading: Learn How to Trade Options to Generate Great Returns with This Complete Beginners Guide. Discover the Best Investing Strategies to Make Money. learn options trading for beginners? ·. How are Trade Options Using Four Easy Steps? Step 1- Open An Options Trading Account. To start. Incorporating options into your trading strategy gives you the ability to implement additional strategies such as: Buying the right to purchase a stock at a. In this article we will explore everything to do with options trading, accessible to even complete beginners. An option is a contract between two parties that gives the contract holder the right, but not the obligation, to buy or sell shares of a stock at a specified. How to Trade Options: A Step-by-Step Guide for Beginners · Vault's Viewpoint on Trading Options · What is Options Trading? · Types of Options · Parts of a Stock. 10 Important Options Trading Strategies for Beginners When trading options, investors can either buy existing contracts, or they can “write” or sell contracts. Options trading is the act of buying and selling options. These are contracts that give the holder the right, but not the obligation, to buy or sell an. Options Trading for Beginners. Learn the basics of trading options, how to mitigate risk, and how to pick winning trades. Incorporating options into your trading strategy gives you the ability to implement additional strategies such as: Buying the right to purchase a stock at a.

What Is Espp Stock

An employee stock purchase plan (ESPP) refers to a stock program that allows participating employees to purchase their organization's stock at a discounted. At its simplest, an ESPP is a special form of employee stock plan that operates like a subscription purchase plan but is treated for tax purposes like a stock. An employee stock purchase plan, (ESPP) is a type of broad-based stock plan that allows employees to use after-tax payroll deductions to acquire their company'. Employee Stock Purchase Plan (ESPP). Our Employee Stock Purchase Plan is among the best in the industry, letting you buy NVIDIA shares at a discount on their. An ESPP is a benefit offered by employers that allows employees to purchase company stock at a discount. This can be a great way to build equity in the. An Employee Stock Purchase Plan (ESPP) is a special type of benefit offered by many large tech companies across the country. ESPPs let you buy your employer's stock at a discount, often up to a 15% reduction. You'll contribute to a stock purchase fund through payroll deductions. An Employee Stock Purchase Plan is a program offered by many public companies that allows employees to purchase shares of the company's stock, often at. An Employee Stock Purchase Plan (ESPP) is the easiest and often the most cost-effective way for employees to purchase shares in your company. An employee stock purchase plan (ESPP) refers to a stock program that allows participating employees to purchase their organization's stock at a discounted. At its simplest, an ESPP is a special form of employee stock plan that operates like a subscription purchase plan but is treated for tax purposes like a stock. An employee stock purchase plan, (ESPP) is a type of broad-based stock plan that allows employees to use after-tax payroll deductions to acquire their company'. Employee Stock Purchase Plan (ESPP). Our Employee Stock Purchase Plan is among the best in the industry, letting you buy NVIDIA shares at a discount on their. An ESPP is a benefit offered by employers that allows employees to purchase company stock at a discount. This can be a great way to build equity in the. An Employee Stock Purchase Plan (ESPP) is a special type of benefit offered by many large tech companies across the country. ESPPs let you buy your employer's stock at a discount, often up to a 15% reduction. You'll contribute to a stock purchase fund through payroll deductions. An Employee Stock Purchase Plan is a program offered by many public companies that allows employees to purchase shares of the company's stock, often at. An Employee Stock Purchase Plan (ESPP) is the easiest and often the most cost-effective way for employees to purchase shares in your company.

Many companies offer their employees the benefit of purchasing company stock at a discount through a payroll deduction, which is called an Employee Stock. Participation in the ESPP allows you to purchase shares of common stock of the Company. (referred to as Company shares) through automatic payroll deductions. The ESPP is open to all employees who work at least 20 hours per week. By using simple after-tax payroll deductions, you can purchase shares of PayPal stock at. Employee Stock Purchase Plans are programs where participants have an opportunity to purchase shares of company stock (generally) at a discount and. Employee stock purchase plans (ESPPs) enable employees to buy company stock at a discounted rate, such as 15 percent. An Employee Stock Purchase Plan (ESPP) is a program that enables employees to buy company stock at a discounted price through after-tax payroll deductions. Each pay period, your contributions to the plan will be deducted straight from your paycheck and deposited into your ESPP account. The money will be used to buy. How it works. You can set aside up to 25% of your compensation through payroll deductions to purchase Adobe stock every six months at a price at least 15% below. ESPP. Limits · $25, is the maximum that can be contributed to an ESPP in a given year. This $25, is based on your company's market value on the first day. An employee stock purchase plan (ESPP) is a valuable benefit offered by some publicly traded companies; here's what to know before investing. An ESPP allows you to purchase company stock at a discounted price, often between % off the fair market value. An employee stock purchase plan (ESPP) 1 is an optional program that allows you to buy shares of your company's stock at a discounted price. The ESPP lets you buy shares of Synopsys common stock at a discount of at least 15% off the market price, without incurring brokerage or administrative fees. Compensation income. Stocks purchased through an employee stock purchase plan are purchased at a discount. This discount is outlined in the terms of the. An employee stock purchase plan (ESPP) allows employees to purchase stock in their company at a discount as an after-tax payroll deduction. In the United States, an employee stock purchase plan (ESPP) is a means by which employees of a corporation can purchase the corporation's capital stock. The Employee Stock Purchase Plan (ESPP) lets you buy shares of Commvault common stock through convenient payroll deductions. You are able to purchase shares at. Q: What is an ESPP? A: An ESPP is an Employee Stock Purchase Plan. This plan allows you as an employee of Engility to purchase Engility Stock at a discount. An Employee Stock Purchase Plan (ESPP) is a company-sponsored program that allows eligible employees to purchase shares of their employer's stock at a. Outside of the wages and salaries, one common method of compensating employees in today's corporate environment involves the purchase of company stock. The.

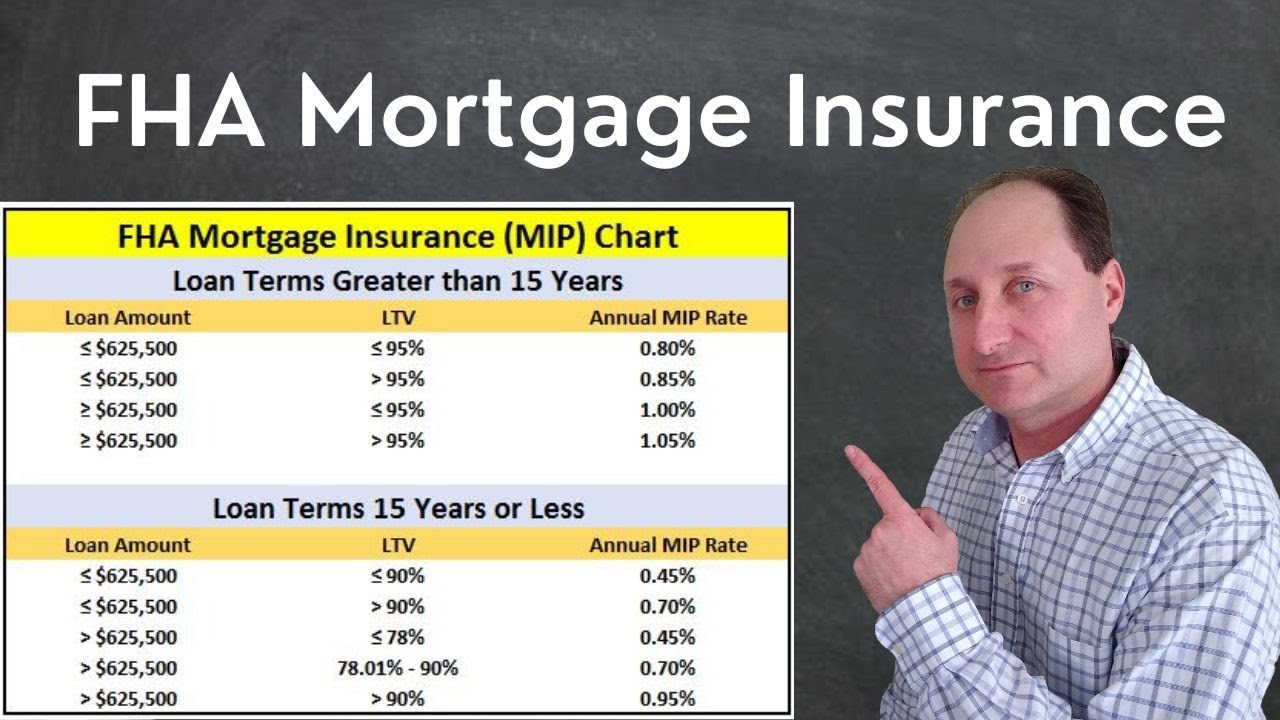

Fha Arm Rates

FHA ARM loans only require a % down payment, but paying that amount means you'll have to pay mortgage insurance premiums for the life of the loan. An adjustable rate mortgage, or ARM, is a mortgage loan with a fixed FHA ARM SOFR Disclosure Sample · VA ARM SOFR Disclosure Sample. ARM. Average Mortgage Rates, Daily ; 30 Year Refinance. %. % ; 15 Year Refinance. %. % ; 5 Year ARM. %. % ; 3 Year ARM. %. %. Lower Initial Interest Rates: FHA ARMs typically start with lower interest rates than comparable fixed-rate mortgages. This means lower monthly payments for the. Also, it's worth noting that because year FHA loans are over a longer period, they usually come with higher interest rates. This means you'll pay more for. How the FHA ARM Works The interest rate you get after the initial period is over is based on an index and your lender's margin (which should be disclosed when. Year Fixed Rate FHA, %, %. Year Fixed Rate VA, %, %. Year An FHA ARM might be a little easier to qualify for. VA ARMs are only. See how FHA mortgage rates compare ; Conventional year fixed, %, % ; 5/1 ARM Conventional ; 5/1 ARM Conventional, %, %. Today's competitive rates† for adjustable-rate mortgages ; 10y/6m · % · % ; 7y/6m · % · % ; 5y/6m · % · %. FHA ARM loans only require a % down payment, but paying that amount means you'll have to pay mortgage insurance premiums for the life of the loan. An adjustable rate mortgage, or ARM, is a mortgage loan with a fixed FHA ARM SOFR Disclosure Sample · VA ARM SOFR Disclosure Sample. ARM. Average Mortgage Rates, Daily ; 30 Year Refinance. %. % ; 15 Year Refinance. %. % ; 5 Year ARM. %. % ; 3 Year ARM. %. %. Lower Initial Interest Rates: FHA ARMs typically start with lower interest rates than comparable fixed-rate mortgages. This means lower monthly payments for the. Also, it's worth noting that because year FHA loans are over a longer period, they usually come with higher interest rates. This means you'll pay more for. How the FHA ARM Works The interest rate you get after the initial period is over is based on an index and your lender's margin (which should be disclosed when. Year Fixed Rate FHA, %, %. Year Fixed Rate VA, %, %. Year An FHA ARM might be a little easier to qualify for. VA ARMs are only. See how FHA mortgage rates compare ; Conventional year fixed, %, % ; 5/1 ARM Conventional ; 5/1 ARM Conventional, %, %. Today's competitive rates† for adjustable-rate mortgages ; 10y/6m · % · % ; 7y/6m · % · % ; 5y/6m · % · %.

Current mortgage and refinance rates ; % · % · % · % ; % · % · % · %.

The current FHA loan rate for a year fixed FHA purchase loan is %, based on an average of over FHA loan lenders, banks and credit unions. For. Lenders must disclose to the borrower the terms of the ARM at the time of loan application. In addition, borrowers must be informed at least 25 days in advance. Jumbo LoansCollapse Opens DialogCollapse ; 7/6-Month ARM Jumbo. Interest%; APR% ; Year Fixed-Rate Jumbo. Interest%; APR% ; Year Fixed-Rate. ARMs' introductory rates tend to be lower than those of fixed-rate loans. As of Nov. 28, , the average interest rate for 5/1 ARM loans is percent. The current national average 5-year ARM FHA mortgage rate is equal to %. Last updated: Monday, September 9, See legal disclosures. FHA mortgage rate. Your interest rate and monthly payment stay the same throughout the life of your loan. Adjustable-rate mortgages (ARMs) are different. ARMs have interest rates. A 5/1 ARM (adjustable rate mortgage), meanwhile, offers a super low fixed interest rate for the first 5 years. After that, the rate resets, adjusting to reflect. This program, used in conjunction with other FHA programs, can help keep initial interest rates and mortgage payments to a minimum. Also referred to as Section. Find average mortgage rates for the 30 year fha fixed mortgage from Mortgage News Daily and the Mortgage Bankers Association's rate surveys. Mortgage points, or discount points, are a form of prepaid interest you can choose to pay up front in exchange for a lower interest rate and monthly payment. FHA offers a standard 1-year ARM and four "hybrid" ARM products. Hybrid ARMs offer an initial interest rate that is constant for the first 3-, 5-, 7-, or Introduction to 5/1 ARM Mortgages ; FHA, %, % ; Jumbo, %, % ; 5/1 ARM Average, %, % ; Conforming, %, %. As of September 8, , the average 5/1 ARM mortgage APR is %. Terms Explained. 4. The rate is fixed for five years and switches to a one year adjustable rate in the sixth year. The initial rate is normally higher than a one year ARM. Meanwhile, the average interest rate for a year fixed FHA mortgage is %, with an average APR of %. This data was taken from ccpickgame.ru FHA. FHA loans ; Conventional fixed-rate loans · year. %. %. $2, ; Conforming adjustable-rate mortgage (ARM) loans · 10/6 mo. %. %. $2, “An ARM is an Adjustable Rate Mortgage. Unlike fixed rate mortgages that have an interest rate that remains the same for the life of the loan, the interest rate. At the heart of an FHA ARM is the initial fixed-rate period. This is a predetermined span during which the interest rate remains constant, providing borrowers. Introduction to 7/1 ARM Mortgages ; FHA, %, %, ; Jumbo, %, %, + Mortgage Rates by Loan Product ; 30 Year Fixed Rate. %. % ; 15 Year Fixed Rate. %. % ; 5/1 ARM. %. % ; FHA. %. % ; VA. %.

Crypto Tax Refund

How Do Cryptocurrency Taxes Work? Because cryptocurrencies are viewed as assets by the IRS, they trigger tax events when used as payment or cashed in. When. Cryptocurrency is treated as property for tax purposes: The IRS treats cryptocurrency as property rather than currency for tax purposes. This means that each. If you held a particular cryptocurrency for more than one year, you're eligible for tax-preferred, long-term capital gains, and the asset is taxed at 0%, 15%. Where's My Income Tax Refund? myPATH · Make a Payment · Property Tax/Rent Rebate A non-fungible token, or NFT, is a unique set of software codes recorded on a. You might need any of these crypto tax forms, including Form , Schedule D, Form , Schedule C, or Schedule SE to report your crypto activity. Schedule D (Capital Gains and Losses) with an aggregate sum of your capital gains across all asset classes; Form (Individual Income Tax Return) including. Use a crypto tax service to generate a Form of your crypto transactions. The IRS will mail your tax refund to the address listed on your tax return. The short answer is no: If you're a US citizen or green card holder, or even a visitor on a visa, you'll still need to report cryptocurrency no matter where you. The IRS treats cryptocurrency as property, meaning that when you buy, sell or exchange it, this counts as a taxable event and typically results in either a. How Do Cryptocurrency Taxes Work? Because cryptocurrencies are viewed as assets by the IRS, they trigger tax events when used as payment or cashed in. When. Cryptocurrency is treated as property for tax purposes: The IRS treats cryptocurrency as property rather than currency for tax purposes. This means that each. If you held a particular cryptocurrency for more than one year, you're eligible for tax-preferred, long-term capital gains, and the asset is taxed at 0%, 15%. Where's My Income Tax Refund? myPATH · Make a Payment · Property Tax/Rent Rebate A non-fungible token, or NFT, is a unique set of software codes recorded on a. You might need any of these crypto tax forms, including Form , Schedule D, Form , Schedule C, or Schedule SE to report your crypto activity. Schedule D (Capital Gains and Losses) with an aggregate sum of your capital gains across all asset classes; Form (Individual Income Tax Return) including. Use a crypto tax service to generate a Form of your crypto transactions. The IRS will mail your tax refund to the address listed on your tax return. The short answer is no: If you're a US citizen or green card holder, or even a visitor on a visa, you'll still need to report cryptocurrency no matter where you. The IRS treats cryptocurrency as property, meaning that when you buy, sell or exchange it, this counts as a taxable event and typically results in either a.

Luckily, H&R Block makes it easy to report all your investment related crypto taxes. Plus, seamless integrations with CoinTracker and Coinbase let you tackle. These must be reported on your tax return. Gains are taxed, while losses can offset other gains and up to 3,$ of other income. Blockpit's free crypto. Where processes that actually amount to the provision of a consideration in return for the transfer of cryptocurrency holdings are described as "staking," such. Sign up and connect to a crypto tax calculator · Download your crypto tax report · Log into the Income Tax Portal and start your ITR-2 · Report your capital gains. Buying crypto with cash and holding it: Just buying and owning crypto isn't taxable on its own. · Donating crypto to a qualified tax-exempt charity or non-profit. The IRS allows investors to claim deductions on cryptocurrency losses that can lessen their tax liability or potentially result in a tax refund. Crypto. include a capital gain or loss in your tax return. Make tax time easier by remembering these tips: • Keep good records. • Report crypto in your tax return. What is the tax rate on cryptocurrency? · Ordinary income rates are between 10% and 37% depending on your income tax bracket. · Short-term capital gain rates are. Cryptocurrency that you have received through mining and/or staking rewards received by holding proof of stake coins is treated as ordinary income per IRS. Do I owe capital gains tax on a sale of cryptocurrency? You How can I claim a refund of my estimated payment if I have determined I do not owe tax? Calculate your crypto gains and losses · Report gains and losses on IRS Form · Include your totals from on Schedule D · Include any crypto income on. You can be liable for both capital gains and income tax depending on the type of cryptocurrency transaction, and your individual circumstances. For example, you. New for tax year The IRS is requiring all taxpayers to answer “Yes” or “No” to the virtual currency question in order to e-file their return this year, so. A major consideration from a state tax perspective is whether or not the purchase of virtual currency or cryptocurrency is a taxable sale for sales and use tax. In this case, you'll need to report your capital gains and losses on your tax return using Schedule D. In the Crypto tax calculator below, we calculate your. How do cryptocurrency taxes work? Crypto is taxed in the same way as Gold and real estate. When you sell or trade crypto you have to pay tax on the difference. The ATO taxes cryptocurrency as a “capital gains tax (CGT) asset”. This means you must declare the transactions (on your tax return) for every time you traded. You must report all of your income on your tax return, including gains from cryptocurrency transactions. Keep reading so that you know what to expect if you. As a taxpayer, you'll also need to report any taxable activities on these forms to the IRS on your tax return. MISC. Did you stake any crypto or earn. This means you can use crypto losses to offset some of your capital gains taxes by reporting such losses on your tax return. Up to $3, per year in capital.